Stay Ahead of Your Expenses with This Monthly Budget Spreadsheet

Managing your money can be a tedious task, but creating a budget spreadsheet can help you stay on track and achieve your financial goals. A monthly budget spreadsheet is an effective tool that can help you keep track of your income and expenses, so you can make informed decisions about your spending. By using a spreadsheet to budget your finances, you can easily see where your money is going, identify areas where you can cut back, and plan for future expenses. Download our monthly budget spreadsheet, and get started on your path to financial success right away!

How to use each sheet

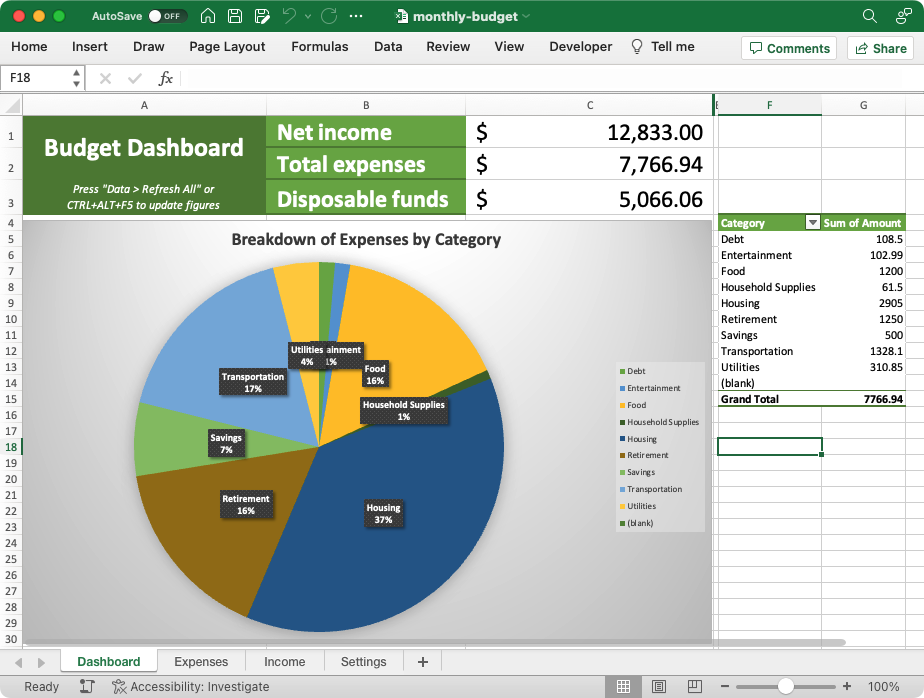

Dashboard

The dashboard (pictured above) summarizes all the spending in your budget. Your total income, expenses, and disposable funds appear at the top, followed by a breakdown of spending by category in a pivot table & chart.

Income and expense totals

- Net income

- Sum of all your earnings in a month. If you add up all the deposits to your bank account(s), they should equal this number.

- Total expenses

- Cost of all your expenses for the month.

- Disposable funds

- Amount of money left over after all your expenses have been paid (i.e., income minus expenses).

Note: Excel only updates the chart once when you open the spreadsheet. After you enter new expenses, make sure to refresh the dashboard figures by doing one of these two things:

- Press CTRL+Alt+F5 (CMD+Option+F5 on Mac).

- Or go to the “Data” ribbon and press “Refresh All”.

Charts

The Breakdown of Expenses by Category is a pie chart and table that explain where your money is spent. The table lists how much was spent in each budget category (such as “Food” and “Household Supplies”). The pie chart shows the same totals, in a visual format that makes it easy to see where the bulk of your funds are spent. To get the most of out the dashboard, make sure to categorize every line item on the “Expenses” sheet.

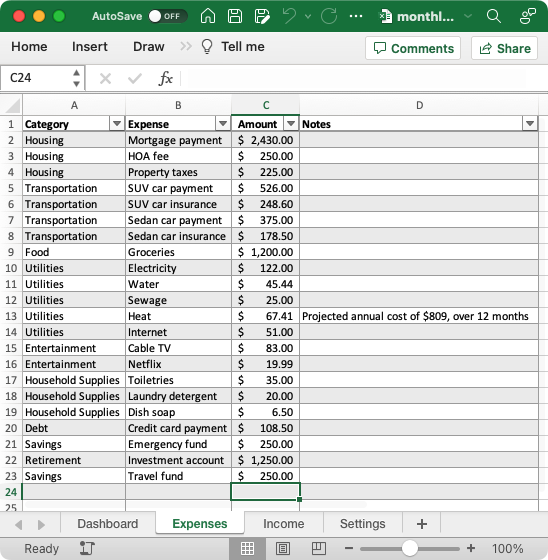

Expenses sheet

The “Expenses” sheet is a list of all your spending for the month. Each time you pay a bill or make a purchase, enter a new line on this sheet. It has four columns, three of which are required:

- Category

- The broad spending category this purchase falls under (pick one from the drop-down list). Required.

- Expense

- A detailed description of what was purchased. Required.

- Amount

- The cost of this purchase. Required.

- Notes

- Any further explanation you think is needed for the expense. Optional.

A common use for the “notes” column is to explain any amounts that are projected. For example, you may pay your car insurance twice per year, but divide the annual total by twelve to see it counted among your monthly expenses. The notes field is a good place to explain something like that.

The sum of “Expenses” column C appears on the dashboard as “Total expenses”.

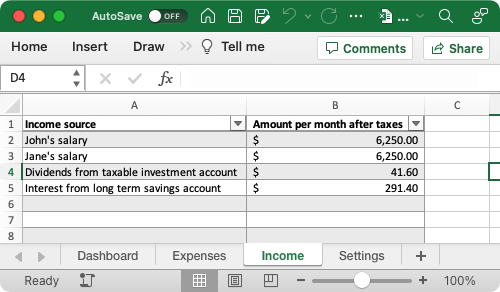

Income sheet

The “Income” sheet is where you enter all the ways you earn money. There are two columns on this sheet:

- Income source

- A description of where the funds were earned.

- Amount per month after taxes

- How much you earn from this income source. This should be the “after tax” number, so that the sum of all the lines equals how much is deposited to your bank account each month.

The sum of “Income” column B appears on the dashboard as “Net income”.

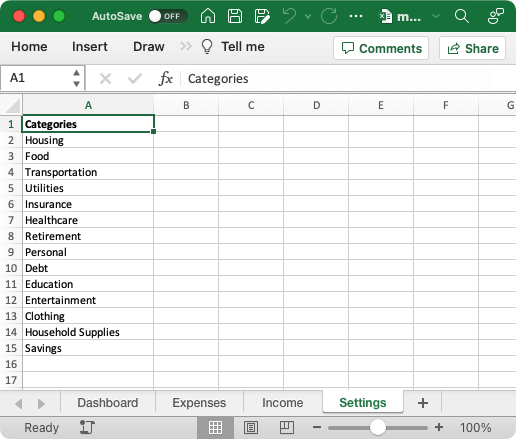

Settings

The “Settings” sheet is where you configure your spending categories. The names entered on this sheet appear in the “Expenses” sheet column A dropdown, and are used to build the “Breakdown of Expenses by Category” chart on your dashboard. The spreadsheet comes pre-configured with common spending categories, but feel free to customize them.

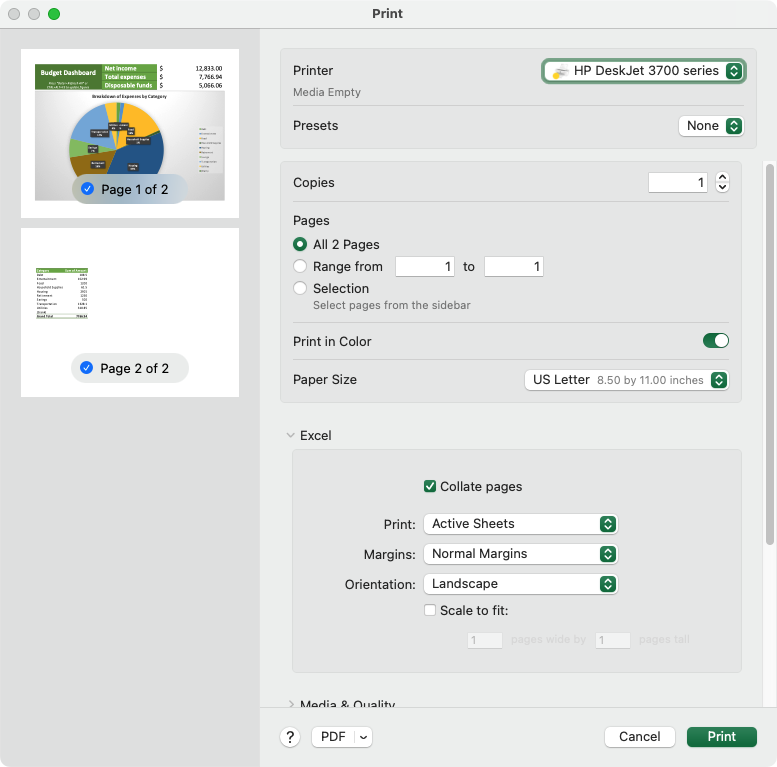

Print your budget

The dashboard is optimized for printing. Change the paper orientation to Landscape and notice how the figures fit neatly on two pages:

- The first page will have your chart and totals.

- The second page will have the table of per-category total spending.

That’s it!

This is a simple, yet powerful spreadsheet. You get a critical overview of your spending in just three steps:

- Enter your income.

- Categorize everything you spend money on.

- Refresh the dashboard and see where your funds are going.

Download our monthly budget spreadsheet and get started.